Past achievements

Our greatest success has been achieved with Kronospan group over 13 years. The company, which is the largest wooden panel producer in the world in terms of scale, was not known in Japan until it joined with I-Works.

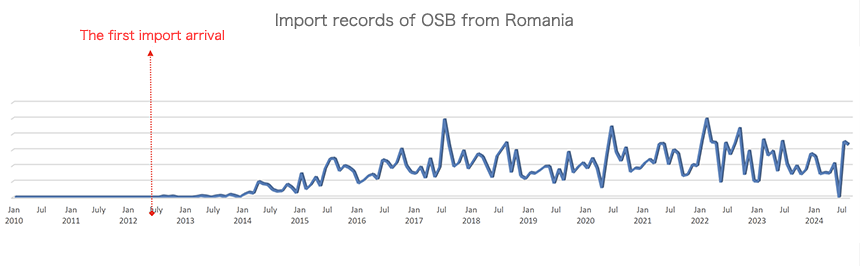

Considering comparisons with competitors, as of 2018, their sales of OSB has gained 10% share of Japanese market, is ranked first in European OSB market, and has very rapidly risen to second rank in Japanese market.

Since then, Kronospan has steadily increased its sales and transaction volume, and its stable growth has stood out more than anything else compared to competitors, even in the face of "Wood Shock" of 2021.

By the end of 2022, almost all of OSB sold at Home Improvement Retailers (so called "Home-Center") in Japan shifted to Kronospan products.

This helped us to increase our total sales volume in 2022 by more than 27% over the previous year.

In 2023, the response to “Wood Shock” led to the first instance of

negative growth since Kronospan entered Japanese market. Nevertheless, the decline was less than half of that experienced by the largest supplier, which resulted in 4% increase in Kronospan's market share.

This is by far the fastest growth rate among all OSB brands in Japan.

Also, its wood panels (MDF, Melamine Faced Particle Board), have all been approved according to Japanese Industrial Standard (JIS), which is said to be the strictest in the world.

This is a first for a European manufacturer, and the same brand is still expanding its business in Japan.

Of course, Kronospan has already obtained ISO9000, 14001, PEFC, and FSC certifications, as well as official certifications required in each exporting country, including PS2-18 for US market.

Examples of companies we have worked with in the past

Kronospan (February 2012 to the present)

- 2013

- Plain particle board received the JIS: the first time for a European company.

- 2018

- MDF and Melamine Faced Particle Board received the JIS: the first time for a European company.

- 2018

- 10% OSB share in Japan throughout the year, which is the highest for a European company, second in total import quantities.

- 2019

- 10% OSB share in Japan throughout the year.

- 2020

- 13% OSB share in Japan throughout the year.

- 2021

- 13% OSB share in Japan throughout the year.

- 2022

- 15% OSB share in Japan throughout the year.

- 2023

- 19% OSB share in Japan throughout the year.

Excerpt from the customs statistics of the Ministry of Agriculture, Forestry and Fisheries.

Swedish flooring manufacturer (June 2010-June 2018)

- 2012

- Products selected as optional items by the largest import housing industry in Japan.

Portuguese flooring company (May 2009-end of 2013)

- 2009

- Development of new import sources. The first imports arrived.

- 2009

- Tokyo Motor Show ·Selected for all of the booth floor of the automaker listed in 1st section of Tokyo Stock Exchange.

An Italian flooring and sound absorbing material manufacturer (February 2008-end of 2017)

- 2009

- Development of new import sources. The first imports arrived.

- 2009

- Exhibited in 'Japan shop' trade fair for the first time.

- 2009

- Tokyo Motor Show ·Products used for all of booth floors of the automaker listed in 1st section of Tokyo Stock Exchange.

- 2010

- COP 10 ·Selected for all of the Ministry of the Environment booths.

- 2010

- Products selected for all of wall materials in Ginza showroom of the audio makers listed in 1st section of Tokyo Stock Exchange.

- 2011

- Selected for construction of earthquake disaster public housing in Fukushima prefecture.

- 2015

- Selected for OEM floor products of the building material manufacturer listed in 1st section of Tokyo Stock Exchange.